Dominance (economics)

| Marketing |

|---|

| Key concepts |

| Product marketing · Pricing Distribution · Service · Retail Brand management Account-based marketing Ethics · Effectiveness · Research Segmentation · Strategy · Activation Management · Dominance Marketing operations |

| Promotional contents |

| Advertising · Branding · Underwriting Direct marketing · Personal sales Product placement · Publicity Sales promotion · Sex in advertising Loyalty marketing · SMS marketing Premiums · Prizes |

| Promotional media |

| Printing · Publication · Broadcasting Out-of-home advertising · Internet Point of sale · Merchandise Digital marketing · In-game advertising In-store demonstration · Word-of-mouth Brand ambassador · Drip marketing · Visual merchandising |

Market dominance is a measure of the strength of a brand, product, service, or firm, relative to competitive offerings. There is often a geographic element to the competitive landscape. In defining market dominance, you must see to what extent a product, brand, or firm controls a product category in a given geographic area.

Contents |

Calculating

There are several ways of calculating market dominance. The most direct is market share. This is the percentage of the total market serviced by a firm or brand. A declining scale of market shares is common in most industries: that is, if the industry leader has say 50% share, the next largest might have 25% share, the next 12% share, the next 6% share, and all remaining firms combined might have 7% share.

Market share is not a perfect proxy of market dominance. The influences of customers, suppliers, competitors in related industries, and government regulations must be taken into account. Although there are no hard and fast rules governing the relationship between market share and market dominance, the following are general criteria:

- A company, brand, product, or service that has a combined market share exceeding 60% most probably has market power and market dominance.

- A market share of over 35% but less than 60%, held by one brand, product or service, is an indicator of market strength but not necessarily dominance.

- A market share of less than 35%, held by one brand, product or service, is not an indicator of strength or dominance and will not raise anti-competitive concerns by government regulators.

Market shares within an industry might not exhibit a declining scale. There could be only two firms in a duopolistic market, each with 50% share; or there could be three firms in the industry each with 33% share; or 100 firms each with 1% share. The concentration ratio of an industry is used as an indicator of the relative size of leading firms in relation to the industry as a whole. One commonly used concentration ratio is the four-firm concentration ratio, which consists of the combined market share of the four largest firms, as a percentage, in the total industry. The higher the concentration ratio, the greater the market power of the leading firms.

Alternatively, there is the Herfindahl index. It is a measure of the size of firms in relation to the industry and an indicator of the amount of competition among them. It is defined as the sum of the squares of the market shares of each individual firm. As such, it can range from 0 to 10,000, moving from a very large amount of very small firms to a single monopolistic producer. Decreases in the Herfindahl index generally indicate a loss of pricing power and an increase in competition, whereas increases imply the opposite.

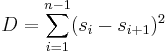

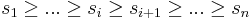

Kwoka's dominance index (D) is defined as the sum of the squared differences between each firm's share and the next largest share in a market:

where

for all i = 1, ..., n - 1.[1]

for all i = 1, ..., n - 1.[1]

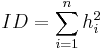

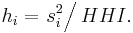

As part of its merger review process, Mexican Competition Commission uses dominance index (ID), described as the Herfindahl index of a Herfindahl index (HHI). Formally, ID is the sum of squared firm contributions to the market HHI:  where

where

European Commission's Tenth Report on Competition implies that a significant disparity between the largest and the second-largest firm shares can indicate that the largest firm has a dominant position in the market. Specifically, under a section entitled "Scrutiny of mergers for compatibility with Article 86 EEC," the Report states:

- A dominant position can generally be said to exist once a market share to the order of 40% to 45% is reached. [footnote: A dominant position cannot even be ruled out in respect of market shares between 20% and 40%; Ninth Report on Competition Policy, point 22.] Although this share does not in itself automatically give control of the market, if there are large gaps between the position of the firm concerned and those of its closest competitors and also other factors likely to place it at an advantage as regards competition, a dominant position may well exist. (European Commission's Tenth Report on Competition, page 103, paragraph 150.)

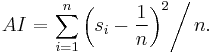

Asymmetry Index (AI) is defined as the statistical variance of market shares:  [2][3]

[2][3]

Examples

Here are some examples of market dominant products:

- Adobe Flash[4][5]

- Adobe Photoshop

- Apple iPod portable media players

- Facebook[6] Social Networking

- Microsoft Windows[7][8][9], Microsoft Office

- Intel personal computer processors[10]

- Google Internet search

- Cisco Ethernet switching[11]

- Dolby audio technologies

- ARM mobile phone chips[12]

- L'Oréal Group - the world's largest cosmetics and beauty company

Further back in history, the majority of goods which became identified with the task had significant market dominance - Kodak, Instamatic, Hornby, Scalextric, Meccano to name a few.

See also

References

- ^ Kwoka, J. E. "Large firm dominance and price-cost margins in manufacturing industries." Southern Econ J (1977) vol. 44, pp. 183–9.

- ^ Brown, Donald M., and Frederick R. Warren-Boulton, Testing the Structure- Competition Relationship on Cross-Sectional Firm Data, EAG 88-6, May 11, 1988.

- ^ Warren-Boulton, Frederick R. (1990). "Implications of U.S. Experience with Horizontal Mergers and Takeovers for Canadian Competition Policy". in Mathewson, G. Franklin et al. (eds.). The Law and Economics of Competition Policy. Vancouver, B.C.: The Fraser Institute. ISBN 0889751218.

- ^ 98%: NPD study

- ^ 99.3%: Millward Brown survey, conducted June 2007. "Flash Player Statistics". Adobe Systems. http://www.adobe.com/products/player_census/flashplayer/. Retrieved 2007-06-18.

- ^ [www.facebook.com]

- ^ LinuxWorld

- ^ W3Counter - Global Web Stats

- ^ Market share for browsers, operating systems and search engines

- ^ Harrison, Pete (July 17, 2008). "EU files new competition charges against Intel". Reuters. http://uk.reuters.com/article/technologyNews/idUKL1730607220080718?pageNumber=2&virtualBrandChannel=0.

- ^ "Cisco Gains Market Share In Ethernet Switching". Forbes. http://www.forbes.com/2004/11/17/1117automarketscan06_print.html.

- ^ [Cover Story] ARM CPU Core Dominates Mobile Market - Nikkei Electronics Asia - Tech-On!